Bucks Deposit Regulations 2025: Just how much Would you Deposit?

المحتويات

Blogs

To your and you will after https://happy-gambler.com/12bet-casino/ January step one, 2012, the pace for every calendar year might be not less than the newest deposit directory, because the defined in the point 36a-26, for the 12 months. On the wedding time of the tenancy and a-year after that, such focus will likely be paid for the renter or citizen or credited for the the next leasing fee due in the occupant otherwise citizen, as the landlord otherwise proprietor should dictate. Attention will not paid off in order to a renter the few days the spot where the occupant has been unpaid for more than 10 months in the commission of any month-to-month lease, until the new landlord imposes a late charge to possess for example delinquency. No property manager will enhance the book owed from a renter as the of your own specifications that the property manager shell out on the focus the safety deposit. All of the subscribed and managed on-line casino operating in the us requires the very least put before you start with actual-money playing.

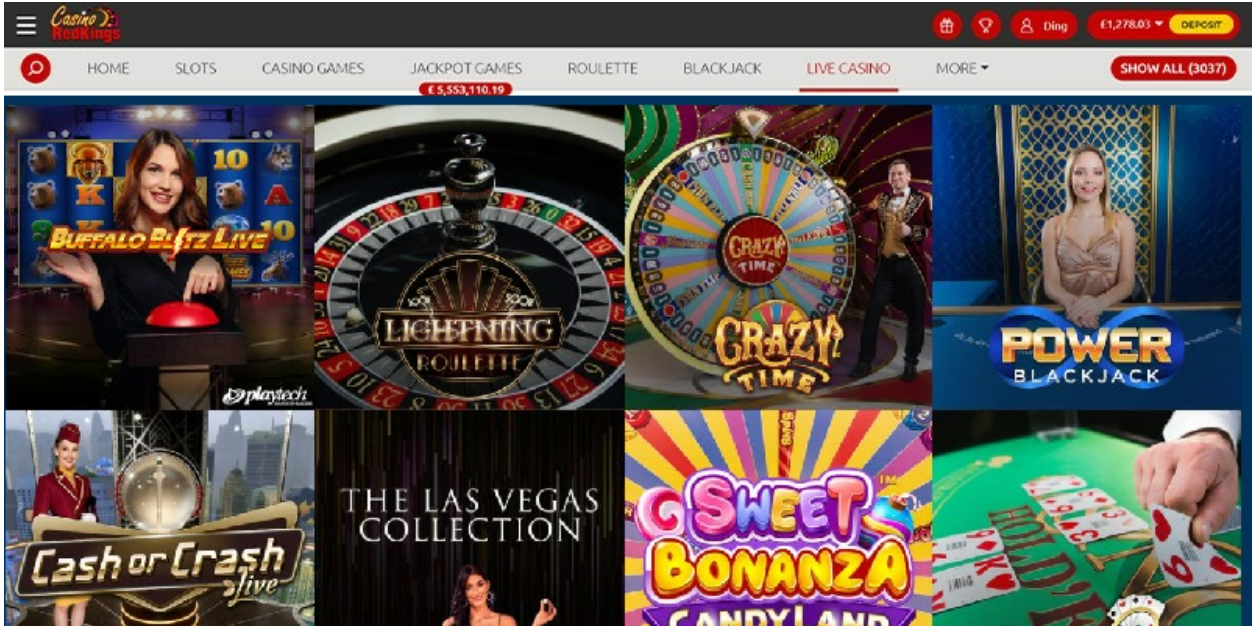

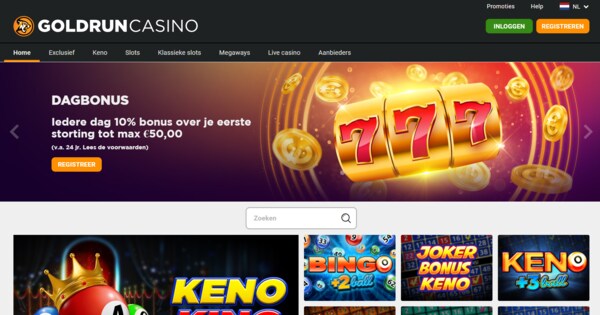

Dollars Put Casinos 2025

The brand new FDIC makes sure the entire equilibrium away from Bob’s places in these specific old age accounts around $250,100000, and that will leave $5,one hundred thousand of their dumps uninsured. FDIC insurance rates talks about depositor membership at each covered financial, dollars-for-buck, along with principal and you may one accumulated desire from time of the insured financial’s closure, as much as the insurance limit. Anyone or organization have FDIC insurance inside a keen covered lender. Men does not have to getting a good U.S. resident or resident to possess their unique deposits covered because of the the brand new FDIC. 5.00%Annual Commission Give (APY) is accurate by Summer 17th, 2025. Certain establishments have the ability to increase the amount of FDIC visibility for the deposits by the sweeping the fresh deposits on the various other using banking institutions.

- Generally, in just about any case’s duration deal, the brand new functions try liberated to negotiate as they need to plus the process of law doesn’t interfere with the brand new functions’ choices.

- If we mistakenly credit your account to have fund to which your aren’t the brand new rightful manager, we would deduct that money out of your account, even if this leads to your bank account getting overdrawn.

- Sure, Dvds try federally insured as much as the maximum, $250,100 for every membership holder.

- Profits typically bring to step 1-three days to process just before they’re also delivered to your account.

- FDIC put insurance rates protects your money inside the put accounts from the FDIC-insured banking institutions and you will discounts contacts in the event of a deep failing.

Just what are POD/ITF and a formal revocable believe account

This means the fresh publicity pays out after any sort of accident your trigger, but just as much as the total amount produced in your own plan. If you lead to some other collision, the newest exposure have a tendency to, once again, pay around one policy limit. Assets damage liability covers injury to most other automobiles, property and you will formations, such fences and mobile poles.

More disturbing than spending a payment for large dollars places is the odds of increasing a brow on the federal government. This means your hard earned money try stored from the banking companies within our system that provide FDIC insurance rates (at the mercy of applicable limits). There aren’t any extra charges to keep Vanguard Bucks Put because the a settlement fund solution.

You may have a joint examining or bank account that have a companion otherwise an aging mother. For many who manage highest stability in your bank account, it’s vital that you know the way much of your currency is part of the brand new FDIC insurance policies restriction. If you don’t, some of your places will be at risk if your bank goes belly up. Purchase $4.99 at the Funzpoints after you create a free account, and you also discovered step one,one hundred thousand Simple Funzpoints at no cost gamble and 500 Advanced Funzpoints to own honor possible gambling.

financial basicsWhere to dollars a

In the isles such Bermuda, betting from the property-centered gambling enterprises an internet-based try court. It indicates Caribbean people can also be sign up in the our leading online sites which have reduced minimal places now. Other countries in the area is actually well-known for licensing online casinos, such as Aruba and you will Curacao.

“Payable on the Demise” (POD) – You can even designate a single or combined account becoming payable up on the death so you can a designated beneficiary or beneficiaries. POD accounts are called “Within the Faith For” (ITF)”, “Because the Trustee For” (ATF), “Transfer on the Death” (TOD) otherwise “Totten Believe” membership and therefore are ruled by the appropriate state regulations. You are only responsible for appointment certain requirements to possess establishing the account while the an excellent POD, as well as one titling criteria. A keen overdraft occurs when you don’t have sufficient cash in your account to pay for a great debit purchase, however, we spend it in any event.

MaxSafe performs similarly to CDARS, even though as opposed to putting currency for the Dvds, you could spread they around the money business profile in the 15 other establishments. There’s an excellent $1,100000 minimum put needed to get started and there are not any monthly fix charge otherwise lowest balance standards. Aside from making it possible to guarantee too much dumps, borrowing from the bank unions could offer various other advantages. For instance, you can also make the most of high interest levels to your deposit membership and you may down charges, than the old-fashioned financial institutions.

The fresh FDIC makes sure places; explores and you may supervises financial institutions to own defense, soundness, and you can user shelter; produces large and you may complex financial institutions resolvable; and you may handles receiverships. However, if which have a hold apply your bank account try an excellent full trouble, get hold of your lender to see if they’re able to provide otherwise progress some of the finance just before it obvious. It’s a similar principle because the a cash deposit; for many who constantly wear’t carry a huge harmony otherwise create high dumps, the lending company wants to see just what’s upwards. Whether it’s at the financial walk-in the department, their teller financial member have a tendency to make sure your account guidance and inquire to possess character. As ever, you’ll complete a deposit slip, as well as the cash is placed in the account.