cryptocurrency news may 7 2025

المحتويات

- Latest cryptocurrency market news may 2025

- Cryptocurrency news april 30 2025

- Cryptocurrency news may 21 2025

Cryptocurrency news may 7 2025

Regulatory activity is also intensifying. The House Financial Services Committee will hold a hearing on digital assets on May 6, while the SEC convenes its third Virtual Asset Roundtable on May 12 imavov ufc record. Eyes are also on the U.S. Senate, which is scheduled to vote on the GENIUS Act on May 26. If passed, the legislation could reshape stablecoin issuance by imposing strict licensing, reserve, and redemption requirements.

Additionally, Microsoft Build (May 19–22) and Google I/O (May 20–21) may highlight Web3 integrations and AI-crypto intersections. On May 28, NVIDIA’s earnings could signal broader market momentum for GPU-based blockchain infrastructure.

Block of Jack Dorsey has guaranteed that Bitcoin payments will reach Square by 2026, confirming Dorsey’s long-time vision of Bitcoin as the Internet-native money. The news holds major implications for merchant adoption and usage of the currency in everyday transactions.

Latest cryptocurrency market news may 2025

Tokenized securities and high-value assets will catalyze DeFi’s growth, adding new liquidity and utility. As a result, we project DeFi’s TVL will exceed $200 billion by year-end, reflecting the growing demand for decentralized financial infrastructure in a digital economy.

Tokenized securities and high-value assets will catalyze DeFi’s growth, adding new liquidity and utility. As a result, we project DeFi’s TVL will exceed $200 billion by year-end, reflecting the growing demand for decentralized financial infrastructure in a digital economy.

It is registered under number 306353686 by the State Enterprise Centre of Registers of the Republic of Lithuania as a Virtual Currency Exchange Operator. FinSeven CZ s.r.o. is a company registered in the Czech Republic (registry code: 22304681), with its address at Na Čečeličce 425/4, Smíchov, 15000, Prague, Czech Republic. Please examine the terms and conditions of the service and consult an expert if necessary.

As cryptocurrency wealth rebounds, we expect affluent new users to diversify into NFTs, viewing them not only as speculative investments but as assets with lasting cultural and historical significance.

Galaxy and members of Galaxy Research may own the coins mentioned, including Bitcoin, Ether, and Dogecoin. Many more predictions were made and not shared, and many more could be made. These predictions are not investment advice, or an offer, recommendation, or solicitation to buy or sell any securities, including Galaxy securities. These predictions represent the point-in-time views of the Galaxy Research team as of December 2024 and do not necessarily reflect the views of Galaxy or any of its affiliates. These predictions will not be updated.

May 2025 solidified the broader bullish structure established earlier in the year, with multiple assets reaching new yearly highs or testing major resistance zones. While momentum slowed toward month-end, technical structures remain constructive across most major coins. The coming weeks may determine whether the crypto market can sustain its current trajectory or enter a deeper consolidation phase.

Cryptocurrency news april 30 2025

The month began with Toncoin trading above the $4.00 mark, building on March’s bullish momentum driven by growing use cases in the Telegram-integrated ecosystem. However, the momentum quickly reversed. By April 6, the token had plunged to a monthly low of $2.75—a 33% drawdown in less than a week. This sharp decline was largely caused by a market-wide correction across major cryptocurrencies, as investors engaged in profit-taking after Bitcoin’s surge past $90,000.

In the final weeks of April, SOL received a strong boost from major institutional announcements. Upexi Inc., a consumer-focused company, revealed its acquisition of over 200,000 SOL tokens valued at $30 million, with plans to invest twice as much over the next phase. Additionally, a Canadian digital asset firm announced a $500 million convertible note facility intended to purchase and stake SOL. These developments signaled growing institutional trust in Solana’s long-term utility and staking rewards.

Notably, it was announced that a prominent European asset manager was preparing to launch a Dogecoin exchange-traded product (ETP). This news, while initially under the radar, started gaining traction within the investor community as it represented a formal step toward institutional accessibility. The growing credibility of meme coins like Dogecoin among traditional finance circles marked a shift in narrative—from satire to strategy.

Despite the heavy selloff, Toncoin showed resilience. By April 9, the price rebounded to $3.13, aided by increased buying activity from long-term supporters and developers within the TON community. This bounce reflected renewed optimism, though it would later be tempered by limited follow-through.

Cryptocurrency news may 21 2025

The memecoin story is one of rotation: the older names (DOGE, SHIB, PEPE) led the April run and are now consolidating, while speculative newcomers attract adrenaline-seekers. The space remains very volatile – a sudden social media post can flip narratives overnight. Investors are advised to treat meme coins as high-risk: many analysts urge caution despite some short-term rallies, noting that broader crypto fundamentals aren’t driving their prices.

Looking ahead, traders eye $300,000 Bitcoin price targets6, contingent on ETF inflows and macroeconomic stability. Policymakers must balance innovation with investor protection, particularly as stablecoins and meme assets test regulatory frameworks. For investors, diversification and risk management remain imperative in navigating this dynamic landscape.

Stablecoins continue to power crypto markets — providing liquidity across CEXs, DEXs, and DeFi. As of April 19, 2025, total stablecoin supply reached $226B, with USDT leading at ~$145B and USDC at ~$61B. Notably, USDC has grown ~39% YTD (vs. USDT’s 7.8%), largely due to institutional demand and regulatory trust.

By merging blockchain with AI, Lightchain AI tackles major challenges like scalability, governance, and privacy, positioning itself as a frontrunner in creating intelligent systems with real-world impact across industries.

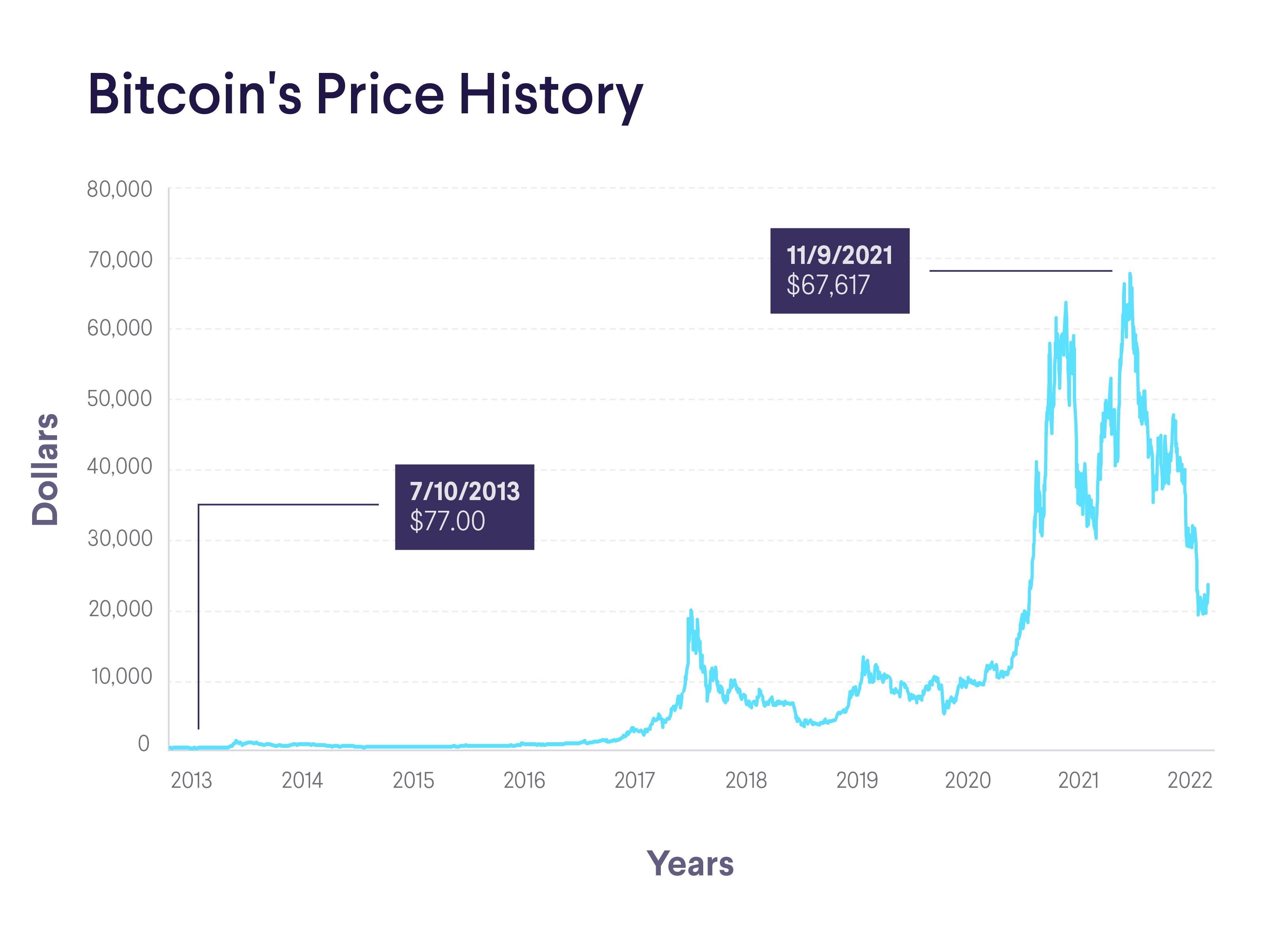

After languishing for several weeks in the midst of tariff-related uncertainty, bitcoin has been steadily climbing in May, up 15% for the month. Cumulative inflows into exchange-traded funds that track the price of bitcoin surpassed $40 billion last week and have seen just two days of outflows in May, according to SoSoValue. The cryptocurrency has benefited from both liquidity in the stock market giving a boost to risk assets, as well as recent risk-off scenarios related to concerns about tariffs and deficits in the U.S. that have driven gains in gold as well as alternate assets like bitcoin.